All companies’ initial task is to ensure a well-organized payroll facility for their employees, whether small or large. If you cannot prepare the payment structure of the employees appropriately, there is a considerable risk of loss. Besides, managing payroll is also essential for keeping records of the company’s activities. Your staff payroll management skills can largely determine the flourishment of the company.

However, it is customary to make mistakes while managing the payrolls manually. A minor clerical error might be the reason for a significant loss. In this case, isn’t it worth finding software that can make this task easier? Of course, it is! Payroll management software can efficiently manage the payment-related functions of the company. But how can you determine which one is the best?

Here I am to help you. This article contains essential information to update you with the best payroll tool in 2024. A lot of software is available to prepare and manage your payroll documents. After researching various software, we have selected the top 10 payroll software in 2024.

Best Payroll Management Software

It is tough to declare a specific payroll tool as the best. Because each contains unique qualities, you can choose your desired software according to your need. But first, you have to know the features of the payroll calculator. Let us look at the best 10 payroll management tools and their key features.

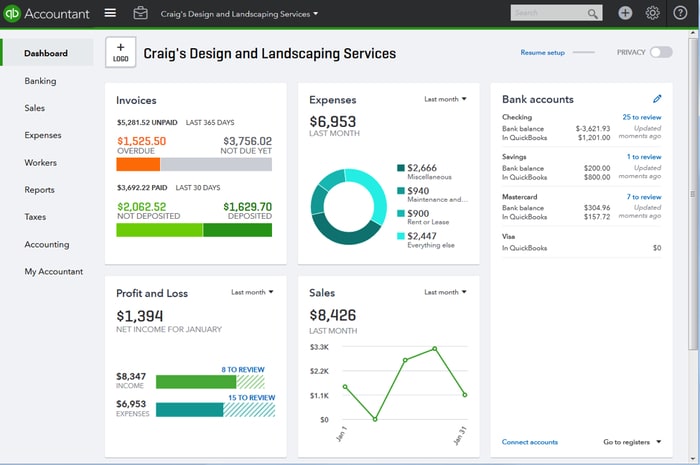

1. Quickbooks

If you are a Quickbooks account user, the most straightforward payroll management system will be ‘Quickbooks.’ This payroll calculator offers a very intuitive interface that anyone can handle. You can set up the software quickly, without any hassle. Besides, it contains knowledge books and tutorials to help you use it properly. You can also look for information online and get many solutions regarding Quickbooks Payroll.

If you are a Quickbooks account user, the most straightforward payroll management system will be ‘Quickbooks.’ This payroll calculator offers a very intuitive interface that anyone can handle. You can set up the software quickly, without any hassle. Besides, it contains knowledge books and tutorials to help you use it properly. You can also look for information online and get many solutions regarding Quickbooks Payroll.

‘Quickbooks’ provides a complimentary 24-hour direct deposit service, allowing you to submit payroll for your whole staff until 5 p.m. the day before payday. In addition, they have launched a new same-day direct deposit service. It also comes with a complete set of payroll and tax compliance tools. You may also get automatic tax updates with this module. It keeps track of the most recent state and federal tax rates to ensure your payroll is accurate. Additionally, you may effortlessly submit and pay taxes straight on the platform. Furthermore, the tax forms are easily accessible.

However, Quickbooks is quite costly software. It offers you several payroll management packages. For simple starting, you have to pay $12 per month. The advanced features require $90 per month.

Key Features

- ‘Quickbooks’ offers a user-friendly interface and hassle-free setup procedure.

- It contains a fast direct deposit feature.

- It provides help from US-based experts.

- You can get 1099 contractor forms and services.

- This software includes accessible tax management features.

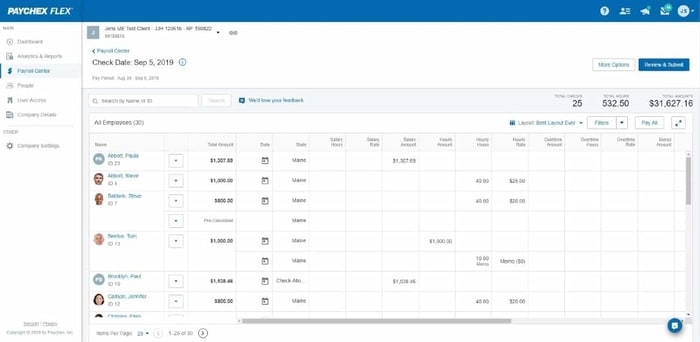

2. Paychex Flex

Paychex is one of the best payroll calculators, especially remarkable for reporting. It offers 160+ clear reports on tax, wages, turnovers, etc. It can automatically check and file your data and information. This software can also efficiently file your payroll taxes. You can also integrate other essential programs with this payroll manager.

Using Paychex Flex is relatively easy. You can set up this software without taking any external support. Moreover, various upgrading options will enrich the prosperity of your business. You can include necessary data fields in the payroll reports. It helps you to manage this task effortlessly. Also, Paychex Flex allows you to integrate with your existing software.

Paychex can act as attendance software and HR software and track time. You have to pay monthly $39 to get the Paychex essential plan, requiring $5 for each employee. You can also go for other software plans according to your comfort.

Key Features

- Paychex Flex offers 24/7 hours of support to its customers.

- It contains HR add-on options.

- This software is efficient in preparing reports.

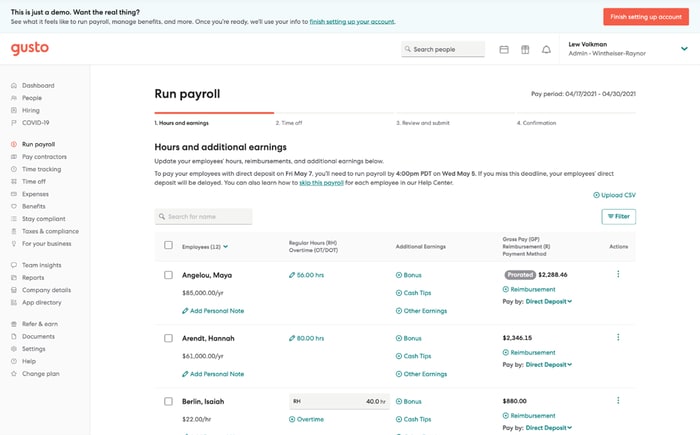

3. Gusto

Gusto is a robust platform integrating payroll, compliance, and benefits management capabilities. It is intended to assist small firms in the United States in growing. It also enables these businesses to handle the HR demands of their employees. In addition, the software has vital payroll functions, a well-designed user interface, and great automation and innovation tools.

Gusto stands out from the competition since it offers a more practical approach to moving through the ranks. Instead of eliminating direct deposit for the cheapest plan, Gusto makes direct deposit more convenient as your plan becomes more costly. Gusto provides almost all facilities within a single software. Calculations, payments, and even the submission of the company’s payroll taxes can all be automated using this tool.

Gusto’s plans are all unique. Each package offers full-service automatic payroll that can be customized to fit the needs of practically any business. Over 40,000 enterprises use Gusto in the United States for their payroll requirements. It also works with various company software and systems, including Deputy, Receipt Bank, FreshBooks, Xero, QuickBooks, and Bamboo HR, to name a few.

There are three different pricing options to think about. First, the Core plan, which is the most affordable, is geared to assist smaller teams. It costs $39 per month as a base pricing + $6 per user. Second, the Complete version costs $12 per user and an extra $39 monthly base fee. The premium package’s base pricing is $149 per month, with an additional $12 per user fee.

Key Features

- Gusto provides an error-free payment management system.

- It contains an intuitive dashboard.

- It can prepare tax reports easily.

- This software provides unlimited payroll runs.

- It is available in all states of the USA.

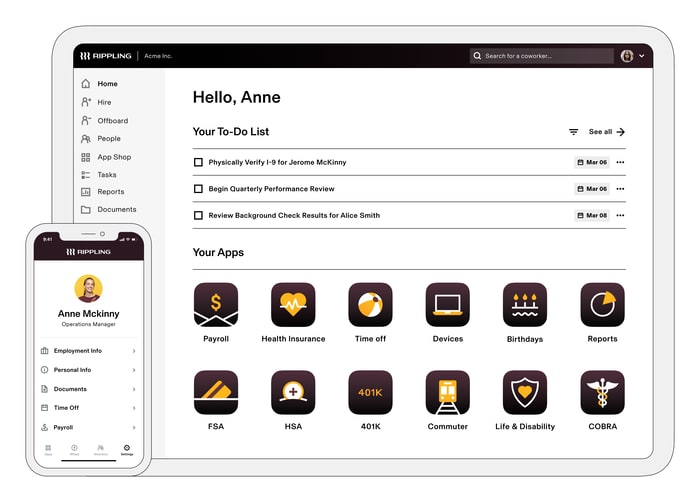

4. Rippling

Rippling is a perfect HR platform for integrating other software. Moreover, it contains payroll as an add-on facility. This software includes many features that simplify your payroll management task. However, you can use it for employee recruitment and benefits, handling payrolls, training, etc. Integration of accounting, attendance, and time management is also essential to getting here.

As a handy payroll management software, Rippling provides no-code workflow automation. Its reporting capacity is also noteworthy. This software can be termed an IT solution for a company. This quick process will ensure you the accurate services necessary to maintain payrolls. Besides, you can integrate all other software on your device with Rippling.

As a handy payroll management software, Rippling provides no-code workflow automation. Its reporting capacity is also noteworthy. This software can be termed an IT solution for a company. This quick process will ensure you the accurate services necessary to maintain payrolls. Besides, you can integrate all other software on your device with Rippling.

Rippling can sync your HR data with payroll. It can perform perfectly to maintain all human resource management activities. This software can save a lot of time through an automated calculation system. It can run payroll within only 90 seconds. The base price of Rippling is $35 and $8 for each employee.

Key Features

- Rippling is cost-effective for small businesses.

- It can integrate with 400+ software.

- It provides automated approval and workflows.

- You will get an auto tax filling feature here.

- It is a unified database for the employees.

5. Workful

One of the best recent software for payroll management is Workful. It has gained the trust of its customers within a short time. Its payroll and time management skills, including geological clock tracking, are mentionable. The employees can also submit their expenses through this software. It can integrate all information about an employee.

Workful provides an effortless user procedure. It contains easy-to-understand directions for small businesses. Though it cannot perform the automated tax-filling task, its other features took Workful to a higher position. It offers you some tutorials for setting up the software. After setting up the time clock, an employee can easily handle the app.

Workful can only integrate with Quickbooks software. It is trying to upgrade into a self-sufficient all-in-all payroll manager. This tool will offer built-in HR features, time tracking, and document storage options. The price of this software is comparatively lower than others. The base price is $25 per month. You also need to pay $5 for each employee.

Workful can only integrate with Quickbooks software. It is trying to upgrade into a self-sufficient all-in-all payroll manager. This tool will offer built-in HR features, time tracking, and document storage options. The price of this software is comparatively lower than others. The base price is $25 per month. You also need to pay $5 for each employee.

Key Features

- Workful is quite an affordable software.

- It offers an intuitive interface.

- It includes a geological time-tracking feature.

- This software provides document storage options.

- Workful can track employee expenses.

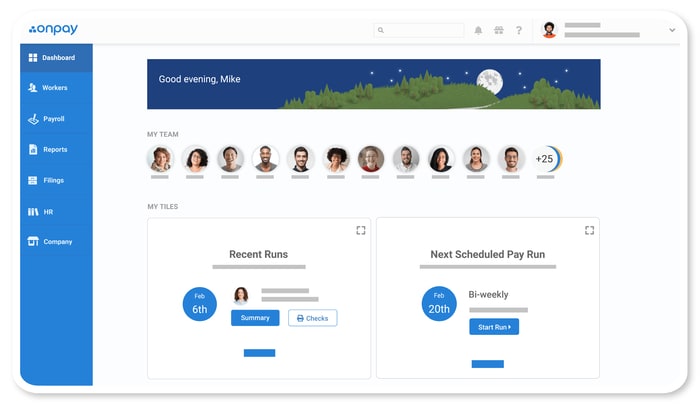

6. OnPay

If you are looking for a suitable payroll tool for running a small business, Onpay can be your best option. It contains rich facilities to serve its clients. The best thing is that there is no hidden charge in this software. It ensures you the automatic calculation of the payroll for your business. Moreover, OnPay is truly cost-effective for a company having a lower capital. However, filing payroll taxes becomes an easy task after using this software.

On pay offers you to set up the payroll software with the help of its setup wizard. You have to provide accurate information. Hours, tips, reimbursements, and bonuses are readily recorded in the system, which may also handle distinct operations such as compensation and benefits insurance. This powerful software can handle infinite monthly payroll and adjusts to W-2, and 1099 needs for full-time or contract staff.

On pay offers you to set up the payroll software with the help of its setup wizard. You have to provide accurate information. Hours, tips, reimbursements, and bonuses are readily recorded in the system, which may also handle distinct operations such as compensation and benefits insurance. This powerful software can handle infinite monthly payroll and adjusts to W-2, and 1099 needs for full-time or contract staff.

OnPay has HR features containing e-signing, offer letters, automated onboarding, etc. You must pay $36 per month and $4 for each staff member to get these facilities. OnPay is indeed a user-friendly software within a limited budget.

Key Features

- Onpay is a cost-effective software.

- It contains an intuitive interface.

- It can prepare 40+ reports.

- This software is available in 50 states of the USA.

- It offers an unlimited monthly pay run.

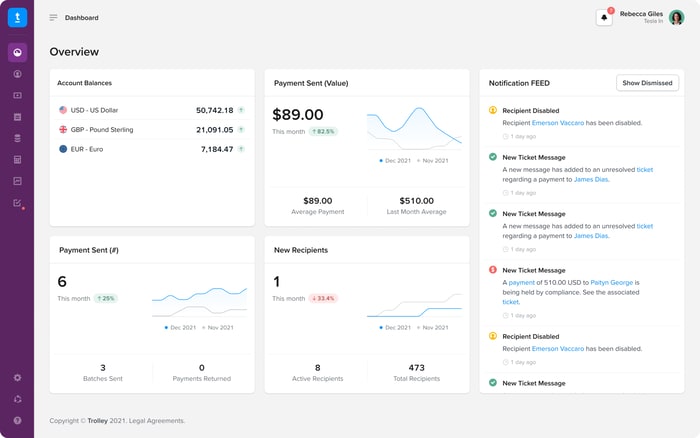

7. Trolley

Another effective payroll management software is Trolley. It was previously named Payment Rails. This software can play a significant role in the flourishing of a new company. Businesses can transmit large payouts in several countries utilizing ‘Trolley’ without navigating intricate organizational procedures or establishing local bank accounts. It’s also handy for companies using online markets and platforms to pay freelancers, independent contractors, advertising, and affiliates.

The Trolley allows you to make payments in real time. It can send payouts on-demand to over 220 countries worldwide. This software can also perform tax-related tasks accurately. Its digital tax calculation method contains TIN matching and IRS E-file reporting facilities. In Trolley, you will find two different pricing systems. Its introductory pricing starts at $49 per month.

The Trolley allows you to make payments in real time. It can send payouts on-demand to over 220 countries worldwide. This software can also perform tax-related tasks accurately. Its digital tax calculation method contains TIN matching and IRS E-file reporting facilities. In Trolley, you will find two different pricing systems. Its introductory pricing starts at $49 per month.

Key Features

- Trolley provides a live payment tracking feature.

- It allows for making instant payments.

- It includes automated payment to an extensive network

- This software contains efficient management for payment recipients.

- It provides strict security provisions.

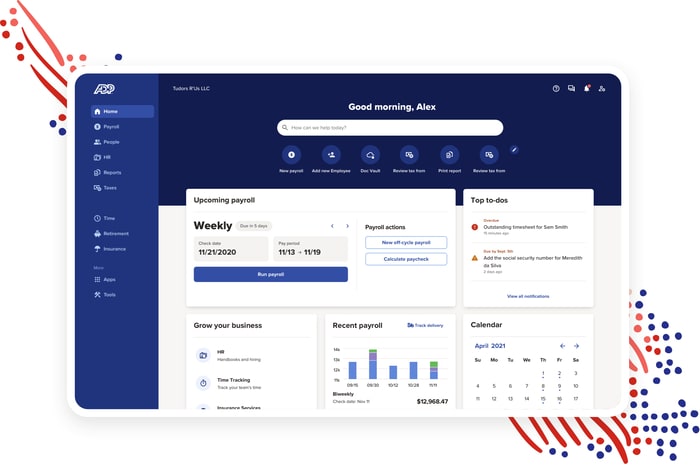

8. ADP

If you want to use Cloud-based HR software, ADP will be perfect. It contains various payment management modules. It also simplifies compliance by having IRS forms on hand. In addition, the solution may produce relevant reports that will provide you with actionable information. In a well-designed dashboard, these are readily apparent. The software’s basic package includes full-service payroll, direct deposit, reports, and a self-service employee portal.

Other essential HR activities, including time and attendance monitoring and onboarding, are integrated with ADP. It also has a wizard for creating benefits plans. However, if only to prevent moving data to a new provider in the future, it’s a good idea to select a payroll solution that can expand your organization. With its ADP RUN service, suited for organizations with fewer than 50 employees, ADP makes this feasible.

Other essential HR activities, including time and attendance monitoring and onboarding, are integrated with ADP. It also has a wizard for creating benefits plans. However, if only to prevent moving data to a new provider in the future, it’s a good idea to select a payroll solution that can expand your organization. With its ADP RUN service, suited for organizations with fewer than 50 employees, ADP makes this feasible.

It works with Cronforce, Performance Pro, and iCIMS, among other programs. Finally, ADP Workforce Now is only available through a custom quotation from the vendor. It is tough to determine the exact price of ADP. Because it doesn’t publish it on its website, generally, it requires $150-$200 for ten persons per month. It is suitable for large companies.

Key Features

- ADP is scalable with a variety of plan choices.

- It has a single database for all information, such as HR, benefits, and time tracking.

- It offers a web-based payroll service with real-time gross-to-net computations for all submissions.

- You will get lots of HR features here.

9. Payroll4Free

Payroll4Free is a free software for payroll management. It is not fully automated. You need to do some paper works to use this payroll manager. For example, unless you’re prepared to pay a small fee, you won’t be able to submit payroll taxes or pay your employees by direct deposit. It includes all of the administrative features required to operate a payroll.

Payroll4Free is a free software for payroll management. It is not fully automated. You need to do some paper works to use this payroll manager. For example, unless you’re prepared to pay a small fee, you won’t be able to submit payroll taxes or pay your employees by direct deposit. It includes all of the administrative features required to operate a payroll.

Although the Payroll4Free setup is manual, it does contain a setup tool to assist you in entering the correct information in suitable locations. This software allows the potential for mistakes, but many payroll software programs do. However, It charges a small fee to run a company with less than 25 members. Payroll tax filing is a monthly fixed rate of $15. Paying your staff by direct deposit will cost you $15 per month.

Key Features

- The essential services of Payroll4Free do not require any cost.

- The fee for tax filing is also affordable.

- It can pay W-2 or 1099 workers.

10. Paycor

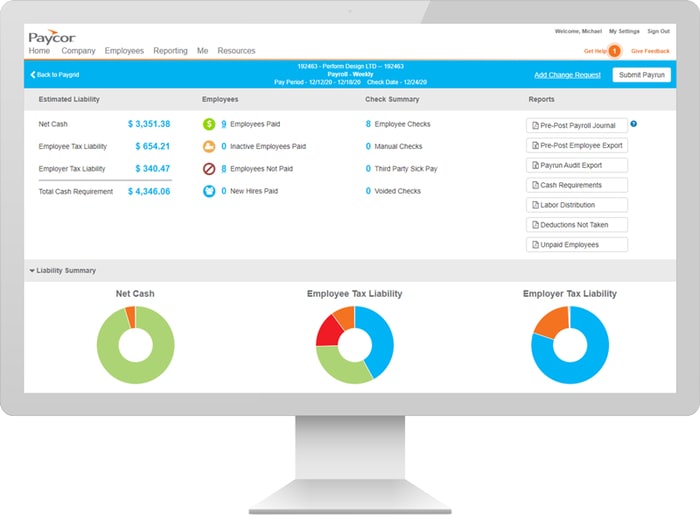

Paycor is a Human Capital Management (HCM) software with a lot of functionality that provides various recruiting, human resources, and salary services. This software has partnered with over 30,000 small and medium-sized enterprises since 2005. This is due to Paycor’s commitment to innovate and provide integration and scalability to its HCM solutions, which are critical in meeting their users’ ever-changing business demands.

Paycor’s HCM technology is considered a cutting-edge, user-friendly platform that enables organizations to better manage their employees by adding HCM solutions tailored to their specific business operations. It can appropriately manage tax-related matters. HCM operations like recruiting and onboarding, payroll, timekeeping, customized support, and user-friendly technologies are also used to enhance such procedures. This software is straightforward to handle.

Paycor’s HCM technology is considered a cutting-edge, user-friendly platform that enables organizations to better manage their employees by adding HCM solutions tailored to their specific business operations. It can appropriately manage tax-related matters. HCM operations like recruiting and onboarding, payroll, timekeeping, customized support, and user-friendly technologies are also used to enhance such procedures. This software is straightforward to handle.

All relevant forms for the onboarding process are included in the Paycor program. New workers may even enter their data into the platform, which helps cut expenses and speed up the process. It has become one of the most popular payroll management software for 2024.

Key Features

- Paycor contains comprehensive HCM Software.

- It is user-friendly software.

- It provides uniform HCM solutions.

- Its tax compliance features are noteworthy.

- Paycor has a deep analytical capacity.

Final Thoughts

Payroll software can calculate an employee’s earnings based on hours worked and wages. It also sets aside the appropriate amount for payroll taxes, including the required federal, state, and local taxes. By using such software, handling a business can become more manageable. It also saves a lot of time and performs its duties properly. Payroll management software can eliminate the errors of manual calculation and prepares payrolls within a short time. But, to enjoy all these facilities, you must choose the right software.

The top 10 salary management software for 2024 mentioned above are a gem in their sectors. You only have to select the perfect one from the list and apply it to your business management. I hope that you won’t be dissatisfied. I will eagerly wait for your feedback!