Loan amortization is slowly paying off a debt by regularly making principal and interest payments. It is mainly used for long-term loans like mortgages. Part of each payment goes toward paying down the loan’s principal balance, and the rest goes toward paying interest. As the loan is paid off, the principal balance decreases, and the interest on each payment also decreases. So, find the best Loan Amortization Software review in this article.

What Exactly Are Loan Amortization Programs?

People and businesses can make use of loan amortization software to help them keep track of their loans. The software can figure out loan payments, interest rates, and the amount of the loan’s principal. It also helps people create payment plans, keep track of payments, and get detailed reports on the loan’s progress. Furthermore, it can provide information about the loan’s terms, interest rate, and penalties for paying it off early. By leveraging this software, borrowers and lenders can take advantage of its benefits to ensure timely payments and gain a complete picture of the loan.

What are the benefits of loan amortization software?

The loan amortization software has the following main benefits:

- Less Stress: Amortization software can reduce the stress that comes with managing loan payments by a significant amount. Automating the payment process means people can do math with software. It gives them more time and energy to do other things.

- Accuracy: Loan amortization software ensures that all payments are correct because it removes the chance of making math mistakes. This makes it less likely that you’ll have to pay late fees when you don’t need to.

- Increased efficiency: Loan amortization software simplifies the payment process by letting users track payments quickly and easily. And make changes without calculating payments by hand. This saves both money and time.

- Increased Visibility: Loan amortization software makes it easier for users to see how their loan payments go. Because they don’t have to calculate payments by hand, this helps people better understand their loans and make better money decisions.

- More Control: Loan amortization software gives users more control over their loan payments. They can easily make changes and keep track of their progress. This makes it easier for users to pay their loans on time and reach their financial goals.

The Top 11 Loan Amortization Applications

Getting a loan is complex and comes with a lot of responsibility. Once you decide to get a loan, you need to make sure you pay it back on time, so you don’t hurt your credit score and don’t end up not paying it back. This is where software for loan amortization comes in. Loan amortization software helps you keep track of your loan payments and ensures you are on track to pay off your loan on time. In this article, we’ll talk about the ten best programs for loan amortization.

1. SimpleNexus Mortgage Platform

SimpleNexus is a secure mortgage technology platform in the cloud that makes it easy for lenders, borrowers, and real estate agents to work together during the mortgage process. It lets lenders simplify the loan process, make their operations more efficient, and improve the customer experience.

SimpleNexus is different from legacy systems in that it offers a single platform that connects everyone involved in the mortgage process. Borrowers can safely store documents, apply for prequalification, read and agree to loan disclosures, and submit applications.

SimpleNexus is different from legacy systems in that it offers a single platform that connects everyone involved in the mortgage process. Borrowers can safely store documents, apply for prequalification, read and agree to loan disclosures, and submit applications.

SimpleNexus is changing the mortgage industry with its secure, cloud-based platform that helps lenders be more productive and give better customer service. Real estate agents can let borrowers know how their loans are going, give them feedback, and answer their questions in real time. On the lender side, SimpleNexus lets loan officers access data and documents from any device, automate manual tasks, and process loans faster. It also gives lenders the information they need to improve their business by tracking and monitoring loan performance with powerful analytics.

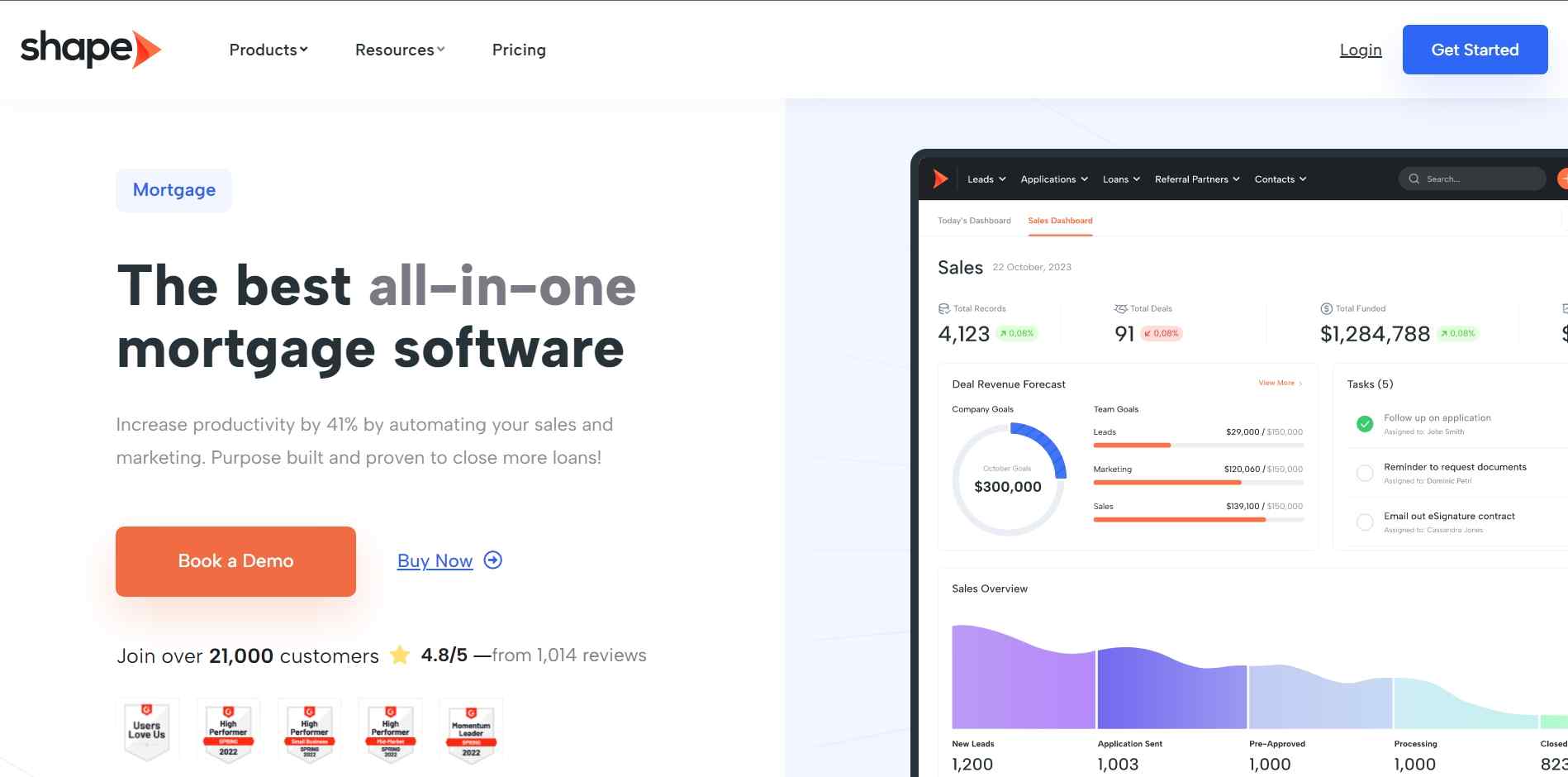

2. Shape Mortgage Software

Shape Mortgage Software is a complete loan origination system. It makes it easier for loan originators and lenders to start, manage, and close mortgage loans. It automates opening and managing loan files and makes opening, processing, and closing loans easier. The software automates the creation of loan documents, the scheduling of loans, and the review of loans. It also gives you access to third-party services for credit, fraud, and compliance. It is meant to give lenders an edge over their competitors by streamlining their loan origination process and making it easier and faster for them to close loans.

With Shape Mortgage Software, lenders can save time and money by eliminating manual processes, reducing paperwork and mistakes, and improving the customer experience. The software also has an enterprise reporting platform that helps lenders track and analyze their loan portfolios and monitor how well their loans are doing. It is safe and follows all federal and state rules and regulations. Shape Mortgage Software is an excellent way for lenders of all sizes to start new loans. It is easy to use and can be changed, so lenders can make it fit their needs. It saves lenders money and gives them a safe, reliable platform for managing loan origination.

3. LendingPad

LendingPad is a company that uses financial technology to help the mortgage business. The company offers an integrated platform that combines software and services to make the loan process faster and cheaper. The platform aims to speed up the mortgage process, from getting a loan to processing, underwriting, and closing.

With LendingPad, lenders can access a secure, web-based system with tools like automated loan origination and underwriting, document management, and e-signature capabilities. With these tools, lenders can save time and money and speed up the loan process.

With LendingPad, lenders can access a secure, web-based system with tools like automated loan origination and underwriting, document management, and e-signature capabilities. With these tools, lenders can save time and money and speed up the loan process.

The platform also has features like a dashboard for loan status, custom reports, and tracking for compliance in multiple states. LendingPad’s all-in-one platform helps lenders improve their loan processes, reduce the costs of making loans, and improve the customer experience. LendingPad follows all federal and state rules and is committed to giving its customers a safe and reliable platform. The company offers other services, such as loan origination and underwriting consulting, workflow automation, and loan document management. LendingPad is helping to change the mortgage industry with its all-in-one platform and services.

4. LoanCatcher

LoanCatcher makes it easy and safe for borrowers to search for, compare, and apply for loans quickly and easily. It is an online service that helps people who need loans find the best ones. The LoanCatcher platform allows borrowers to compare loan products from different lenders and determine which loan terms are best for them.

Borrowers can use LoanCatcher to find lenders who offer the best rates, terms, and payment plans for their needs. LoanCatcher also has an easy-to-use application process and automated loan tracking services to ensure borrowers get the best loan package for their situation. LoanCatcher also lets borrowers put in their credit history and get personalized advice on the best loans for their current financial situation. Borrowers who use LoanCatcher to look at loan options from top-rated lenders can save time, money, and stress.

Borrowers can use LoanCatcher to find lenders who offer the best rates, terms, and payment plans for their needs. LoanCatcher also has an easy-to-use application process and automated loan tracking services to ensure borrowers get the best loan package for their situation. LoanCatcher also lets borrowers put in their credit history and get personalized advice on the best loans for their current financial situation. Borrowers who use LoanCatcher to look at loan options from top-rated lenders can save time, money, and stress.

5. Floify

Floify is a powerful software platform that helps mortgage loan originators streamline their work and stay on top of their tasks. It was made for the mortgage industry and gave them the tools and automation needed to be more efficient and get more work done. Floify helps loan originators save time, money, and other resources to focus on their clients, which is what matters. The software from Floify is easy to understand and use. It helps automate many of the boring and paper-heavy parts of the loan process. Floify makes it easy to talk to clients, keep track of progress, and organize work.

With its powerful tools, Floify makes it easier for loan originators to automate and streamline their work, which helps them serve their clients better. Floify also has many features for lenders, such as customizable forms, automated loan documents, the ability to sign documents electronically, and robust data security. Floify is constantly adding new features and updates to its software, so loan originators can be sure they will always have the latest technology. With Floify, loan originators can easily manage their workflows, improve efficiency, and focus on what’s important: their clients.

With its powerful tools, Floify makes it easier for loan originators to automate and streamline their work, which helps them serve their clients better. Floify also has many features for lenders, such as customizable forms, automated loan documents, the ability to sign documents electronically, and robust data security. Floify is constantly adding new features and updates to its software, so loan originators can be sure they will always have the latest technology. With Floify, loan originators can easily manage their workflows, improve efficiency, and focus on what’s important: their clients.

6. Sageworks Lending Solutions

Sageworks Lending Solutions is a financial technology company that helps banks and other financial institutions with automated loan origination, credit scoring, and portfolio analytics. The company’s primary goal is to help banks manage risk and improve their loan portfolios. Sageworks Lending Solutions provides financial institutions with streamlined loan origination, credit scoring, and portfolio analysis process. Thanks to its patented algorithms and new technology, it does this with the accuracy and efficiency of a large-scale automated system.

Sageworks Lending Solutions helps people get loans and does credit analysis, portfolio monitoring, and consumer analytics. This lets financial institutions figure out how risky their loan portfolios are, keep an eye on consumer habits and trends, and improve how they lend money. With the company’s patented algorithms, banks can quickly and accurately determine how risky their loan portfolios are and decide whether or not to lend.

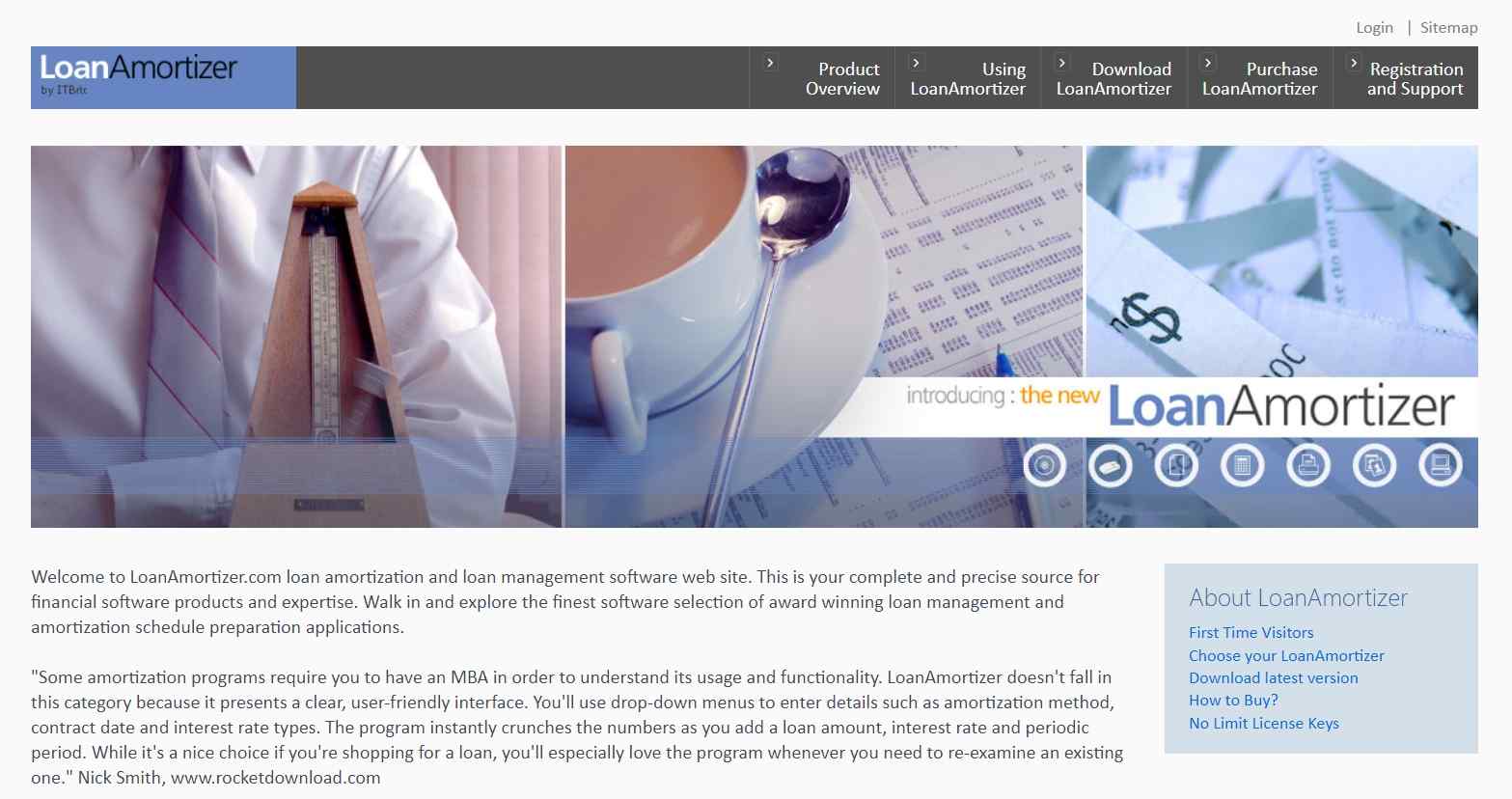

7. LoanAmortizer

LoanAmortizer is a loan amortization program that gets good reviews and can be used by individuals and businesses. It is available in several languages, and its customer service team gets good reviews. Users can keep track of multiple loan payments and make detailed reports. LoanAmortizer also has a loan calculator, a loan comparison tool, a loan payment calculator, and a loan repayment schedule, among other things.

LoanAmortizer is a loan amortization program that gets good reviews and can be used by individuals and businesses. It is available in several languages, and its customer service team gets good reviews. Users can keep track of multiple loan payments and make detailed reports. LoanAmortizer also has a loan calculator, a loan comparison tool, a loan payment calculator, and a loan repayment schedule, among other things.

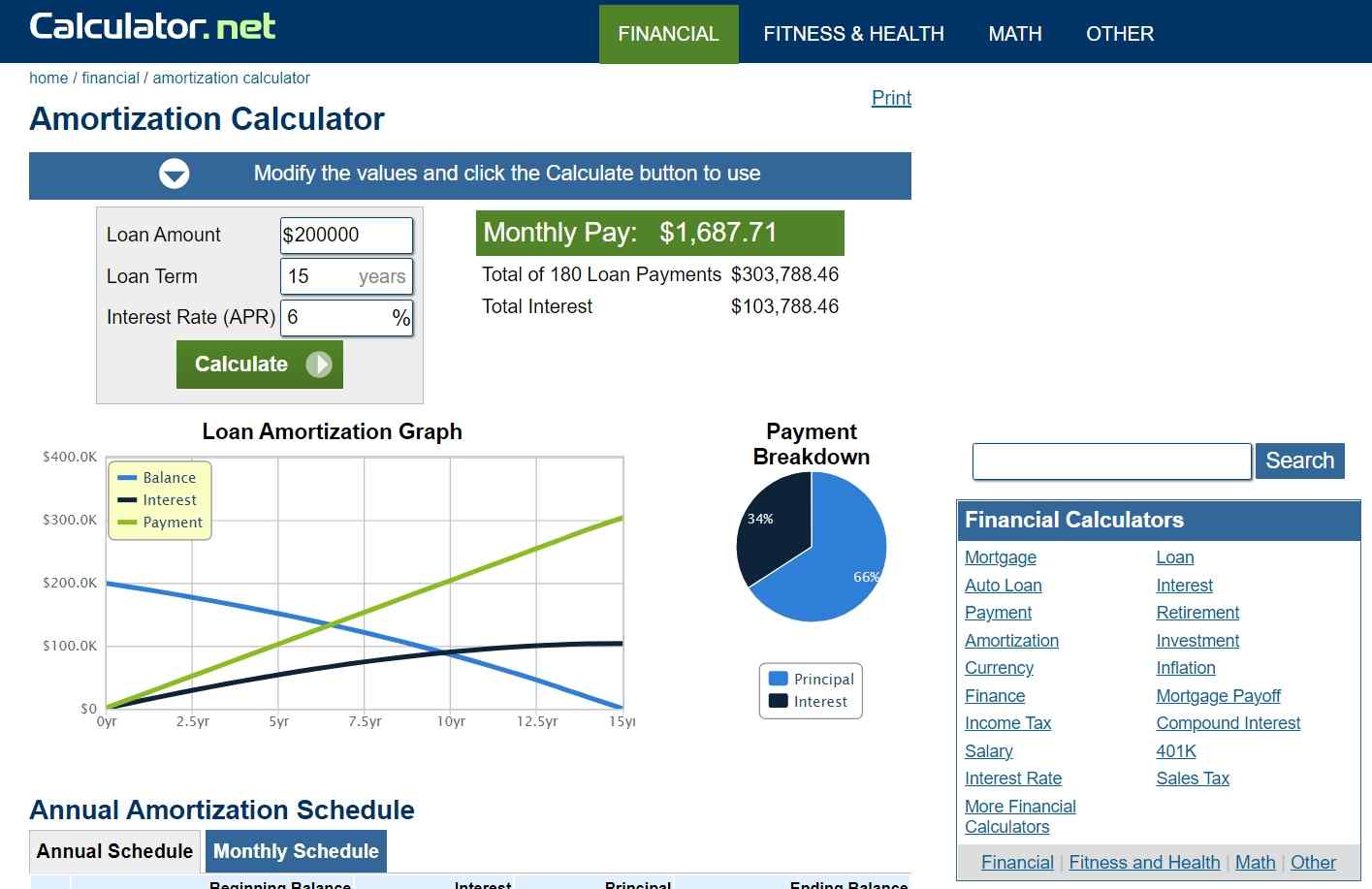

8. Amortization Calculator

The amortization calculator is one of the most popular software used to determine how much a loan will cost over time. It is easy to use and makes accurate payment plans based on the information you put in. The software will also give you a summary of your loan, including the amount you borrowed, the interest rate, and how long the loan will last. You will also see the payment schedule and a breakdown of each payment.

The amortization calculator is one of the most popular software used to determine how much a loan will cost over time. It is easy to use and makes accurate payment plans based on the information you put in. The software will also give you a summary of your loan, including the amount you borrowed, the interest rate, and how long the loan will last. You will also see the payment schedule and a breakdown of each payment.

9. LoanPay Pro

LoanPay Pro is loan amortization software that makes it easy to set up and manage your loan payments online. It is also elementary to use. It helps people who have taken out loans because it lets them keep track of their payments and ensures that the loans will be paid back on time. The software will also provide you with an amortization schedule, which will assist you in preparing for your loan payments.

LoanPay Pro is loan amortization software that makes it easy to set up and manage your loan payments online. It is also elementary to use. It helps people who have taken out loans because it lets them keep track of their payments and ensures that the loans will be paid back on time. The software will also provide you with an amortization schedule, which will assist you in preparing for your loan payments.

10. LoanStar

LoanStar is powerful loan amortization software that can help you keep track of your loan payments. It has an easy-to-use interface and makes it simple to set up payment plans, keep track of payments, and monitor them. The program also gives you many valuable tools to help you analyze your loan payments. And make sure you’re making the right decisions about your loan. And stay on top of your obligations to pay back your loans.

LoanStar is powerful loan amortization software that can help you keep track of your loan payments. It has an easy-to-use interface and makes it simple to set up payment plans, keep track of payments, and monitor them. The program also gives you many valuable tools to help you analyze your loan payments. And make sure you’re making the right decisions about your loan. And stay on top of your obligations to pay back your loans.

11. LoanBuddy

LoanBuddy is another well-known piece of software that can help you keep track of your payments and loan payments. It has a simple user interface lets you customize your loan payments and see your amortization schedule. With the software, you will also be able to set up automatic payments so that you never miss a payment again.

LoanBuddy is another well-known piece of software that can help you keep track of your payments and loan payments. It has a simple user interface lets you customize your loan payments and see your amortization schedule. With the software, you will also be able to set up automatic payments so that you never miss a payment again.

Conclusion

Loan amortization software is excellent for people who take out loans. It makes it easy for them to track and manage their payments. This article discusses the ten best software programs that can help make sure the right choices are made for a loan. With the right software, it’s easy to keep track of payments, make plans for paying back the loan and make detailed reports. Now that you know about the ten best debt calculation software programs, it’s time to choose one. Before making a choice, you should think about your needs, budget, and each software’s features. If you have any comments, please leave a comment.